#372

Everyone Loves Tendies

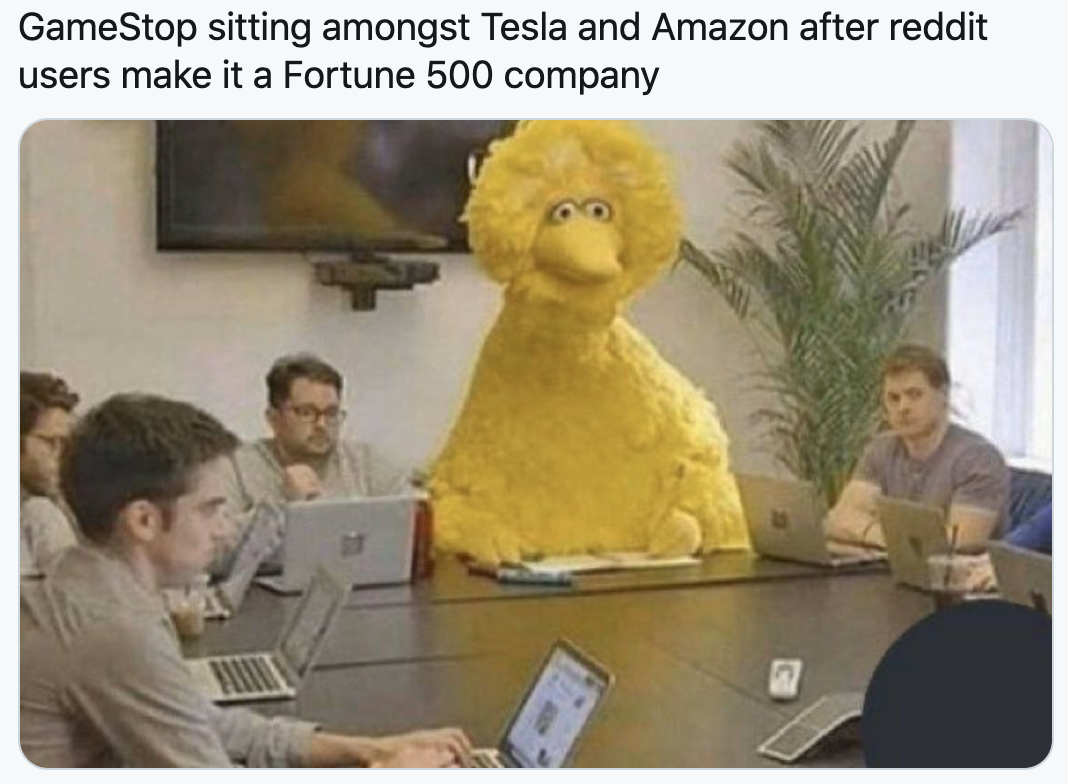

What do Congresswoman AOC, Elon Musk and Reddit user RoaringKitty/DeepF*****Value have in common? They obviously love chicken tenders, but all also agree that retail investors should not be barred from trading some stocks.

This crazy week in stock trading has undoubtedly brought together some bizarre connections and unlikely interactions. AOC and Ted Cruz agreeing on something(?), Chamath (a.k.a Champtons) becoming the ultimate populist hero, and Steve Cohen (of hedge fund P72) twitter engaging with Dave Portnoy - the same guy who used scrabble tiles to pick stocks last year.

This is the beginning of the meme stock (or stonk) revolution - powered by the democratizing of financial markets access. What is likely to come out of this is an even greater participation of main street in wall street. Robinhood alone added over 2m users this week (from 13m)!

There is no doubt rules of engagement are likely to change both for retail, institutional investors, and regulators. While the masses inevitably started the buying frenzy, the price of some stocks kept going up (despite retail trading platforms halting trading) which implies that professionals, hedge funds and trading firms were buying!

While most of the r/WallStreetBets members like to think of themselves as having “diamond hands” (read hands of steel), it's really all about celebrating the tendies, slang for gains; the etymology of the word comes from chicken tenders, widely regarded as a dish “suitable for kings and financial oligarchs”.

NYDIG strengthens leadership with appointment of Jacqueline D. Reses to board of directors - Ms. Reses is a veteran entrepreneur with extensive public company board experience, and a member of the Federal Reserve Bank of San Francisco's Economic Advisory Council. Ms. Reses will maintain a particular focus on the expansion of NYDIG's growing Platform Solutions business, enabling insurance companies, banks, and fintechs to offer bitcoin-related services, working closely with NYDIG's newly-appointed President, Yan Zhao. Read more

Plaid unveils deposit switch to digitize account funding - Plaid’s instant switch process links a consumer’s payroll or employer account via Plaid Link. Staffers at firms big and small, as well as freelance workers, can access instant account funding. Plaid is also developing a backup process for consumers who can’t harness its instant switch process whereby consumers will have the capacity to request that Plaid reach out to their employer for them to revise their direct deposits without firms needed. Read more

Why neobanks will ascend only at the speed of trust - Portfolio company Oyster's founder & CEO - Vilash Poovala - shares his thoughts on the conditions affecting the pace at which challenger banks will rise in Latin America. Read more

FinTech Collective participates in eighth edition of Finnosummit - Investment team member Carlos Alonso Torras participated in Finnovista's eighth edition of Finnosummit this week, sharing perspectives on key fintech themes for Latin America in 2021. Read more

Everyone Loves Tendies

Anger as brokers curb retail investors’ bets on GameStop - Large US brokers, including Schwab and Robinhood, on Thursday curbed trading in shares including GameStop, AMC and BlackBerry. The move came as the biggest brokerages and apps for retail trading faced intense demand from users in the battle between day traders and professional short-sellers that has generated record trading volumes on Wall Street. Read more

How a penny stock explodes from obscurity to 451% gains via chat forums - On any given day, there are a dozen or more Blue Sphere-like stories of tiny, profitless companies that mysteriously go from obscurity to viral sensation. Lately the frenzied pace of boom and bust in these penny stocks has started to drown out all the other forms of speculative mania in the pandemic-era market. Read more

Keith Gill drove the GameStop Reddit mania. He talked to the Journal - To many, Mr. Gill—who until recently worked in marketing for Massachusetts Mutual Life Insurance Co.—is the force behind the quadruple-digit gains in shares of the videogame retailer GameStop, up more than 1600% this year through Friday. Many online investors say his advocacy helped turn them into a force powerful enough to cause big losses for established hedge funds and, for the moment, turn the investing world upside down. Read more

Robinhood, in need of cash, raises $1b from its investors - Robinhood, one of the largest online brokerages, has grappled with an extraordinarily high volume of trading this week as individual investors have piled into stocks like GameStop. That activity has put a strain on Robinhood, which has to pay customers who are owed money from trades while posting additional cash to its clearing facility to insulate its trading partners from potential losses. Read more

Industry News

Payments firm Flywire plans IPO at $3b valuation - Founded in 2011, Flywire has processed more than $16b in transactions and employs more than 550 people in offices across the United States, Europe and Asia. The Boston-based company is focused on facilitating payments in the education, healthcare and travel sectors, and counts Singaporean state investor Temasek Holdings and the venture arm of private equity firm Bain Capital among its backers. Read more

Brexit forces interest-rate derivatives trading shift to US - The sharp move in activity came in the wake of the UK and EU failing to reach a “mutual equivalence” agreement on cross-border regulation of derivatives trading following the UK’s departure from the trading bloc. A permanent shift to New York would be particularly damaging for London. Read more

Jack Ma’s Ant plans major revamp in response to Chinese pressure - Ant Group is planning to turn itself into a financial holding company overseen by China’s central bank, responding to pressure to fall fully in line with financial regulations. The plan represents a significant turnaround by a digital-payments juggernaut that has in recent years tried to shed its image as a financial-services provider and fashion itself as an internet-technology company, which helped it command lofty valuations. Read more

Allstate to sell life insurance unit to Blackstone for $2.8b - Since the world-wide financial crisis of 2008, private-equity, asset-management and other types of financial firms have bought up blocks of life-insurance policies and annuities, and even entire operating units, as insurers narrowed their focus and divested product lines. Ultra-low interest rates have prompted much of the activity, hurting insurers’ profits. Read more

JPMorgan plans rollout of UK digital retail bank - The digital bank will have offerings and functionalities designed to meet the requirements of British customers through a mobile app. JPMorgan believes the country has a “vibrant and highly competitive” consumer banking arena, and, for that reason, the company created the bank from the ground up to meet the requirements of clients there. Read more

Harvard, Yale, Brown endowments have been buying Bitcoin for at least a year - Back in 2018, Yale University Chief Investment Officer David Swensen made headlines by backing two crypto-focused venture funds, one run by Andreessen Horowitz and another launched by Coinbase co-founder Fred Ehrsam and former Sequoia Capital partner Matt Huang. Several other universities followed Yale in backing crypto VCs, including Harvard, Stanford, Dartmouth College, MIT, University of North Carolina and Michigan. Clearly, some of those schools appear to be taking the next step by investing directly in crypto assets. Read more

Revolut disrupted banking in Europe—can it do the same in the U.S.? - Since launching in 2015, financial upstart Revolut has become a force in Europe by offering cheap foreign exchange and a growing suite of digital banking services. Now, it plans to conquer the U.S. market—provided, that is, Americans take note of its existence. Read more

Reserve Bank of India 'exploring the possibility' of a digital currency - According to a booklet on payments released today by the RBI, the bank is “exploring the possibility as to whether there is a need for a digital version of fiat currency.” The bank added that if it found a need, it would look into ways to put digital currency into use. Read more

European Central Bank sets up climate change centre - The European Central Bank is to set up a climate change centre, uniting the disparate work streams operating across the bank. Read more

Sweden's Trustly plans $11b IPO as digital payments boom - The appeal of financial technology companies has increased during the COVID-19 pandemic as more people shop online and make payments digitally to avoid physical contact. Trustly’s revenues were around 130m euros in 2019 and will be around 200m euros for 2020 on a “double digit” core earnings (EBITDA) margin. Read more

Coinbase chooses direct listing route to public markets - Digital currency wallet service Coinbase said in a blog post that it plans to join the public markets by way of a direct listing. In December, the company shared that it confidentially filed an S-1 with the Securities and Exchange Commission. The S-1 has not been made public as of yet. Read more

LatAm fintech investment: startups with ‘regional DNA’ attract attention - LatAm fintechs with international growth plans are highly attractive investment opportunities, say venture capital executives. Read more

Select Financings

Albert - California based financial advisory platform raised $100m in Series C funding led by General Atlantic. Read more

Alma - France based installment payments platform raised €49m in Series B funding from Cathay Innovation, Bpifrance, Seaya Ventures and Picus Capital. Read more

Check - New York based payroll infrastructure startup raised $35m in Series B funding led by Stripe. Read more

Cowrywise - Nigeria based digital wealth management and financial planning startup raised $3m in pre-Series A funding led by Quona Capital. Read more

dYdX - San Francisco based maker of a decentralized exchange raised $10m in Series B funding led by Three Arrows Capital and DeFiance Capital. Read more

Elinvar - Berlin based wealth management platform-as-a-service startup raised €25m in new funding led by Toscafund Asset Management. Read more

Fast - San Francisco based online checkout company raised $102m in Series B funding led by Stripe and Addition. Read more

Loanpal - San Francisco based point-of-sale payment platform for solar and other home efficiency solutions raised more than $800m in new funding led by NEA and WestCap Group. Read more

Melio - Israel and New York based provider of accounts payable and receivable tools for vendor payments raised $110m in Series C extension funding led by Coatue. Read more

MotoRefi - Virginia based auto refinancing startup raised $10m in Series A-1 funding led by Moderne Ventures. Read more

Nubank - Brazil based challenger bank raised $400m in Series G funding led by GIC, Whale Rock and Invesco. Read more

Paystone - Canada based payments and integrated software company raised $69m in strategic funding led by Canadian Business Growth Fund. Read more

Pilot - San Francisco based automated accounting service for SMBs and startups raised $60m in Series C funding led by Sequoia Capital. Read more

Rhino - New York based insurtech company focused on rent raised $95m in growth funding led by Tiger Global Management. Read more

Roostify - San Francisco based digital platform for mortgage lenders raised $32m in Series C funding led by Ten Coves Capital. Read more

Scalapay - Ireland based “buy now, pay later” platform raised $48m in Seed funding that includes debt and convertible notes led by Fasanara Capital. Read more

Sidecar - Los Angeles based health insurance startup raised $125m in new funding from investors including Drive Capital, BOND, Tiger Global Management, and Menlo Ventures. Read more

Token - London based open banking payments platform raised $15m in Series B funding led by SBI Investment and Sony Innovation Growth. Read more

FinTech Collective Newsletter

Curated News with Context

Delivered every Monday, the weekly newsletter, produced by our team, provides a tightly edited rundown of global fintech news, along with a bit of our original analysis.